阿拉伯联合酋长国¶

配置¶

Install the following modules to get all the features of the United Arab Emirates Payroll localization:

名称 |

技术名称 |

描述 |

|---|---|---|

United Arab Emirates - Payroll |

|

包括所有规则、计算和薪资结构。 |

United Arab Emirates - Payroll with Accounting |

|

包括与薪资模块相关的所有账户。 |

员工¶

First, configure the employee general information and then configure the following fields under the Private Information tab:

Nationality (Country): The nationality affects an employee’s payslips, whether they are nationals or expats.

Identification Number: Used to extract the WPS report.

Bank Account: Used to extract the WPS report and generate payments for those employees.

注解

The Nationality (Country) field needs to be set even if the employee is a UAE national since there is a different type of handling if they are citizens of a GCC country.

合同¶

Once the employee form has been created, ensure the contract is enabled by clicking on the Contracts smart button, or going to .

The following contractual information related to employees working in the United Arab Emirates are found under the Salary Information tab:

工资类型:为全职或兼职员工选择 固定工资,或为按小时支付工资的员工选择 小时工资。

Scheduled Pay: the frequency of payslip issuance.

Wage: Monthly or Hourly depending on the Wage Type.

Housing Allowance

Transportation Allowance

Other Allowance

注解

The allowance values set on the contract are used on the payslip lines as allowances.

Number of Leave Days: Used to specify the number of annual leave days that an employee deserves in a particular year. Regardless of the actual number of leaves that the employee gets (extra leave days for some internal company reasons), the final calculation of the end of service and unpaid leaves is dependent on the number set on this field.

注解

The Number of Leave Days affects the calculation for unpaid leave provisions.

Is DEWS Applied: DIFC Employee Workplace Savings (DEWS), if the employee is a UAE national and has DEWS applied, tick this checkbox.

Computed Based On Daily Salary: Defines the way that the end of service is calculated:

Do not tick this checkbox if the standard calculation is to be used. This computes the compensation amount by dividing the monthly salary by 30 and then multiplying it by 21.

Tick this checkbox and directly set the actual Daily Salary so that it is used in the end of service calculation.

Salary structures and salary rules¶

Other input rules¶

The following are the different allowances that can be defined directly on the payslip form to allow for the values that are set against these inputs to affect the WPS calculations as monthly variable salaries for the specific employee that they are linked to.

Rules that are related to the WPS setup, are linked to other input types, and whenever they are used, their values are reflected on the WPS as monthly variable salary for that specific employee.

Type |

Code |

Conveyance Allowance |

|

Housing Allowance |

|

Medical Allowance |

|

Annual Passage Allowance |

|

Overtime Allowance |

|

Other Allowance |

|

Leave Encashment |

|

End of service (EOS)¶

End of service (EOS) provides the calculation for the allowance that the employee gets at the end of their service. It is triggered when the employee’s departure reason is set by archiving the employee’s record.

There are several different calculations depending on the scenario:

The Employee spent less than a year in the company: The employee does not get any EOS allowance since they are not eligible for it (they are eligible once they complete their first year in the company).

The Employee spent more than a year and less than 5 years in the company: The employee is eligible for an equivalent of 21 days of salary for each year they spent on the company.

注解

There are two ways for calculating the daily wage that gets paid for the employee against the 21 days of the EOS: Either by the default way of dividing the monthly basic wage by 30. Or, it can be manually input on the contract of the employee under the Daily Salary field.

The Employee spent more than 5 years in the company: The employee is eligible for an equivalent of 30 days of salary for each year they spent on the company. In this case, if the default method is used, then the employee gets paid an equivalent of 1 month of salary, and the set Daily Salary field, they will get the amount for the day multiplied by 30.

注解

There are two payslips printout formats, one for normal salaries and one for end of service payslips, it is based on the employee being archived and having a departure reason or not.

End of service provision (EOS Provision)¶

The EOS provision provides the calculation for the end-of-service provision amount that the company puts aside every month to count for the EOS that will be paid to them as an EOS allowance.

Unlike the EOS, the provision is part of the employee’s payslip from the start of their contract.

Just like the EOS, the provision has two calculations depending on the period spent by the employee in the company:

Less than 5 years: \(\frac{\text{Monthly Wage}}{30}\times{\frac{21}{12}}\)

More than 5 years: \(\frac{\text{Monthly Wage}}{30}\times{\frac{30}{12}}\)

注解

This rule is not shown to the employee on the payslip printout and it does not affect their net payable, it is only for internal use by the company.

Annual leave provisions¶

Annual leave provisions are used for calculating the annual leave provision accumulated each month, just like the EOS provision, it does not affect the total amount paid to the employee, it is for internal use by the company.

It is calculated by dividing the employee’s total salary (Total Salary = Wage + Allowances) by 30 to get the daily salary. The daily salary is then multiplied by the eligible leave days and divided by 12 to determine the monthly provision amount.

Annual remaining leave balance rules¶

Annual remaining leave balance rules are used for calculating the amount to be paid to or taken from the employee based on the number of leave days deserved by the employee during the current year.

The annual leave time off type is specified using the Is Annual Leave checkbox.

If enabled, the rule calculates the amount of leave days deserved by the employee up to the current date and subtracts the number of annual leave days taken, and if the result is positive, this means that the employee should be compensated for remaining amount and if negative this means that the employee is liable to the company for the difference.

Sick leave rules¶

Sick leave rules provide the calculation for cases where the employee is on sick leave and decides how the payslip should be affected.

There are 3 cases for the employee to have:

Fully paid sick leave: The employee can upload a sick leave certificate (SLI). Employees are eligible for 15 days of this type of leave per calendar year.

小技巧

The SLI is not mandatory in Odoo but can be done from the setup of the time off types.

50% paid sick leave: Same as the fully paid one, but the employees are eligible for 30 days from this leave type. These 30 days are counted after the first 15 fully paid days.

0% paid sick leave: Same as the fully paid one, but the employees are eligible for 45 days from this leave type. These 45 days are counted after the first 15/30 fully/half-paid days.

重要

As per the labor law of the United Arab Emirates, the 15, 30, 45 days are not specified as working days or calendar days so this point will rely on the company policy.

The amount paid for the employee per sick leave day is counted as follows:

Where the gross per month is the basic + all other allowances set on the employee’s contract.

Daman investments end of service programme (DEWS)¶

DEWS allows for calculating the DEWS amounts for the employees who are eligible for it and would like to be registered on it under their current contract with the company.

It is calculated based on the number of years that employees have spent in the company:

Less than 5 years: 5.83% is deducted from the employee’s BASIC salary towards the DEWS.

More than 5 years: 8.33% of The employee’s BASIC is deducted from the total payable for that employee.

Unpaid leaves¶

Unpaid leaves allows for calculating the amount to be deducted when an employee takes an unpaid leave. It is calculated by the following equation:

Where the gross per month is the basic + all other allowances set on the employee’s contract.

Out of contract days¶

The out of contract days rule provides a calculation for the days before/after the contract period that overlaps with the contract of days on the employee’s payslips.

Example

Payslips are generated for the period of 1st-30th of September but the contract expires on the 21st, in this case, there are 7 days flagged as out of contract.

It is calculated by the following equation:

Manual deductions¶

Manual deductions allows the user to add manual deductions to be applied to employees per payslip.

The amount to be deducted and the description of the deduction is to be set directly on the payslip manually as other inputs.

净工资¶

净工资显示的是员工根据工资单获得的净额。

计算方法是将基本津贴与所有津贴相加,再从中扣除所有扣减额。

重要

针对上述规则采取的方法是,首先获得合同中规定的所有静态金额的全额,然后扣除应扣除的金额,如无薪假期、病假、人工扣款、佣金等。

根据工资单生成会计分录¶

这些账户作为借方或贷方与每条工资单规则相关联,这样,当根据工资单生成草稿分录时,账目上的金额就会相应地反映出来。

账户的设置必须使最终结果分录平衡,否则,如果不平衡就会发出警告,并且不会生成分录。

查看工资单并确保所有金额正确无误后,生成草稿分录,根据设置,可以是所有员工的一个分录,也可以是每个员工的一个分录。

Example

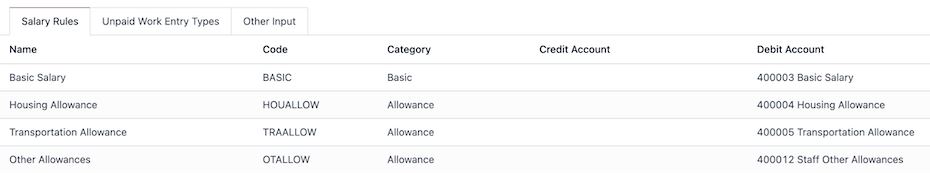

为基本规则和津贴规则设立借记和贷记账户。

向员工支付薪酬¶

在批次或工资单的分录入账后,公司就可以开始向员工支付工资了。

在批次内或工资单上,点击支付按钮即可创建一笔付款,并将其关联至已过账的工资单分录。若通过单一或多个付款银行/现金日记账完成支付,同样可对批次工资单执行此操作。

注解

工资单生成后,员工即可通过门户账户查看工资单。系统会自动发送邮件通知员工,告知其工资单已在门户查看界面生成。

工资单打印¶

工资单可生成两种打印格式,具体取决于工资单类型:*月度*工资单或*服务终止*工资单。若员工在该月被归档(离职),系统将自动触发此功能。

主报表¶

*主报表*详细展示了特定期间内支付给员工的金额,该报表基于该期间生成的工资单数据,并将工资单明细行以列的形式呈现在 Excel 报表中。

该报表主要用于简化人力资源部门的审计流程,提高审计效率。

要访问此报表,请转到 。

工资保障系统(WPS)报告¶

工资保障系统(WPS)报告是企业必须提交的证明文件,用于验证其已按照法定要求准时足额支付员工工资。该报告支持按单个工资单或批量工资单生成。

生成报告前需完成以下准备工作:

进入 并在 阿联酋工资单 WPS 设置 部分配置以下内容:

雇主唯一标识符:设置将在 WPS 报告中使用的公司唯一标识符。

工资银行帐户:选择一个银行帐户或开始输入 创建和编辑 一个新的银行帐户。

重要

设置 工资银行帐户 时,请务必完成以下内容:

账户持有人:设置为公司。

账号:必须是有效的 IBAN。

银行:必须设置 阿联酋路由代码代理 ID。

Send Money: should be enabled and set to Trusted.

Set the unique identifier on all of the employees who are a part of the target of the batch/payslip.

The Identification No field can be found on the employee’s page under the Private Information tab.

Once the initial setup is done, the WPS can be generated either for one payslip or for a batch as follows:

Generate the payslip one by one or as a batch.

Post the draft entity related to the payslips.

Create the payment report and set the Export Format to UAE WPS.

注解

The report comes in a .sif format as per the governmental requirements, so either use

software that can open .sif files or convert it to another format (.xslx) to be

able to review it.

结果文件包括以下内容:

Social insurance contributions¶

Social insurance contributions calculate the social insurance, which is only available to UAE nationals.

The company contributes 15% of the total monthly salary for the employee if the company is in Abu Dhabi and 12.5% if the company is in another Emirate.

注解

The total monthly salary for the employee = [basic + all allowances set on the contract].

On the other hand, the employee contributes 5% of their total monthly salary and that amount gets deducted from the payslip amount.